Unlock your business potential

Find, convert, and keep more customers with LocaliQ’s growth marketing platform. We offer innovative technology and unparalleled expertise to move your business forward.

Unlock your business potential

Find, convert, and keep more customers with LocaliQ’s growth marketing platform. We offer innovative technology and unparalleled expertise to move your business forward.

Elevate your business with the power of LocaliQ

With 20+ years of experience, our proven record of innovation and performance in the digital marketing industry will help you drive results.

Take control of your business goals

with a team of experts behind you

Feel secure knowing you have a partner

that will help you get ahead

Tap into actionable data and insights

with our smart technology

Unlock your business potential

Find, convert, and keep more customers with LocaliQ’s growth marketing platform. We offer innovative technology and unparalleled expertise to move your business forward.

Elevate your business with the power of LocaliQ

Take control of your business goals

with a team of experts behind you

Feel secure knowing you have a partner

that will help you get ahead

Tap into actionable data and insights

with our smart technology

Dedicated to helping local businesses succeed

Products & Services

Built for you and your needs

Be more efficient in your marketing with our all-in-one growth platform. We’ll equip your business with the tools you need to succeed – and thrive.

Find leads and build

your online presence

What we can do for you:

-

Create captivating websites and landing pages

-

Manage and analyze your listings

-

Improve SEO, manage your social media accounts, create content, and more

Scale up your business

What we can do for you:

-

Optimize and manage your search ads

-

Create targeted display ads, video ads, social ads, email marketing, and custom promotions

-

Manage social ads, delivery, and reporting

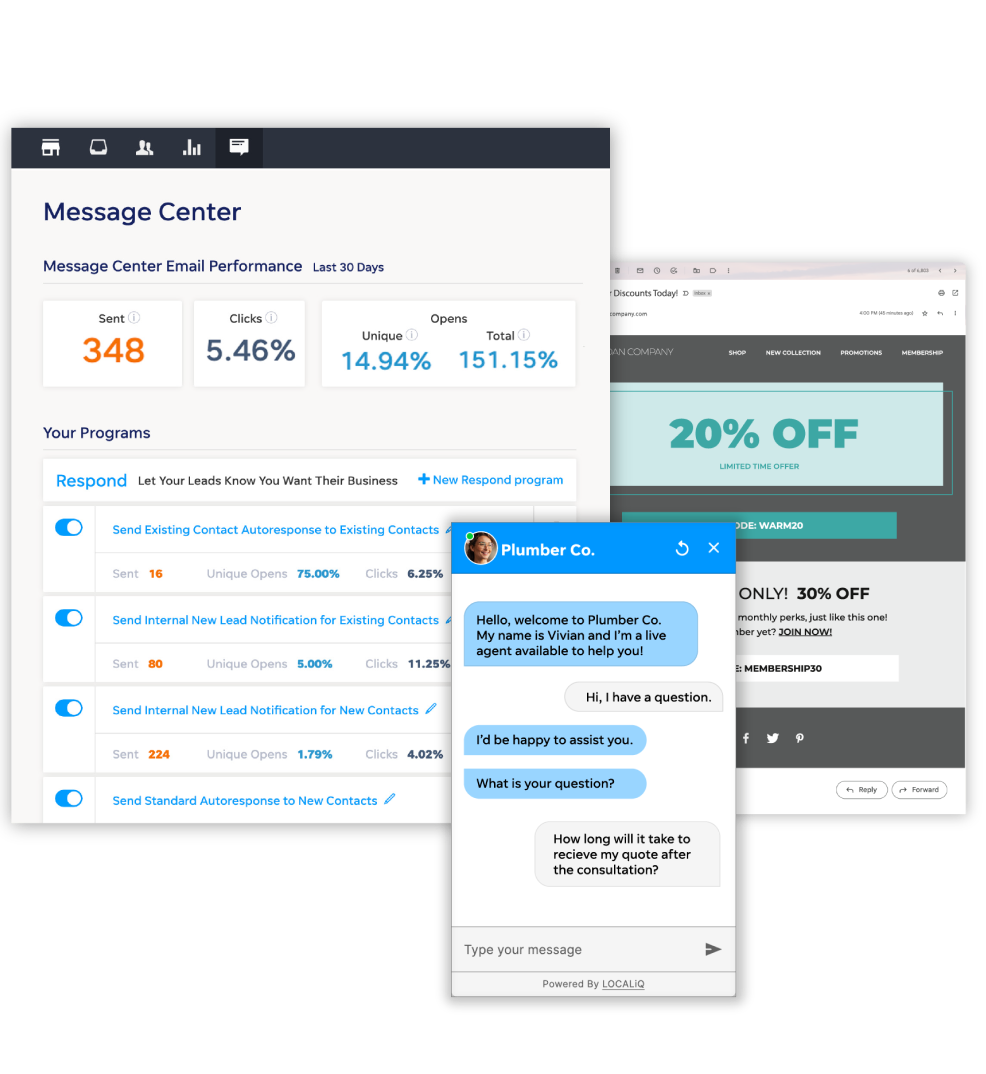

Convert and keep your customers

What we can do for you:

-

Manage your leads, automate marketing, and provide call tracking and recording

-

Monitor and manage live chat 24/7

-

Get instant transcripts, lead qualification, and reporting

Free Website Grader

How does your online presence stack up?

Our Website Grader does more than just evaluate your site performance – it reviews your social media presence and the effectiveness of your digital advertising. Best part? It only takes a few minutes.

Keep up with the latest from LocaliQ

We’ve got your back

Partner with LocaliQ and you can feel confident knowing we’ll help you every step of the way.

4.82

out of 5 on our customers satisfaction score

![]()

3x winner

Google Quality Account Champion award in North America

4 out of 5

customers would strongly recommend LocaliQ

Trusted by 440K+ businesses

Get the power of LocaliQ behind you

Let us help you seize your potential.